Difference between revisions of "Citi thankyou rewards"

(→Point transfers and expiration) |

(→Advantages of Citibank banking relationships) |

||

| Line 219: | Line 219: | ||

<ul class="bulletlist"> | <ul class="bulletlist"> | ||

| − | <li>'''Citigold customers get an additional $145 discount on the Citi Prestige | + | <li>'''Citigold customers get an additional $145 discount on the Citi Prestige Card's annual fee'''. This drops the effective annual fee to $100 per year. This requires $200,000 in combined assets with Citibank, but this includes assets in a brokerage account. If you have a substantial amount of existing retirement or investment accounts that you wouldn’t mind moving over to Citi, you can pay a lower fee on your Prestige Card.</li> |

| − | It has been reported online that if you were a Citigold customer | + | It has been reported online that if you were a Citigold customer and you are not any longer, you may still get the lower annual fee. |

| − | <li>'''You can also earn ThankYou points directly from your banking activity'''. With the Citigold account, you can earn up to 1,600 points per month, depending on how many different Citibank banking and lending programs you use. With a regular Citibank account, you’ll earn less from each program, with a maximum of 1,000 points per month. You can also periodically earn large numbers of points as a banking account signup bonus. Be aware that unlike the points you earn with credit cards, these points will expire 3 years after the end of the year when you earned them | + | <li>'''You can also earn ThankYou points directly from your banking activity'''. With the Citigold account, you can earn up to 1,600 points per month, depending on how many different Citibank banking and lending programs you use. With a regular Citibank account, you’ll earn less from each program, with a maximum of 1,000 points per month. You can also periodically earn large numbers of points as a banking account signup bonus. Be aware that unlike the points you earn with credit cards, these points will expire 3 years after the end of the year when you earned them and can’t be transferred to other people. In addition, they can’t be directly transferred to partner loyalty programs. If you want to use them for award tickets, you’ll need to temporarily transfer them to your Citi Prestige / Premier account first. </li> |

</ul> | </ul> | ||

Revision as of 21:11, 14 January 2021

Credit Card Reference, Introduction to 'Transferable' Reward Points

Citibank’s reward program is called ThankYou Rewards. ThankYou Rewards homepage.

Along with Ultimate Rewards and Membership Rewards, ThankYou Rewards is one of the three big bank-run rewards programs where you can convert your credit card points into miles with your choice of a number of different frequent flyer programs.

ThankYou Rewards is probably the least valuable of the big three “transferable” points programs. It has arguably the weakest set of participating frequent flyer programs, the fewest cards for earning signup bonuses, and annoying rules for holding onto your points when you want to cancel your card.

On the other hand, if you are planning on transferring your points to frequent flyer programs, Citibank's credit cards have the most lucrative "earning rates" of any program.

And even if you don't think ThankYou Rewards is quite as good as the other two programs, you can still get great value by collecting their signup bonuses and using your points for free airplane tickets.

Even if you don’t want to mess with finding awards space, you can still use your points, at 1 or more cents each, to purchase travel through Citibank’s website. So a 60,000 point signup bonus is still worth at least $600-660 in cash and often considerably more.

Jump to

Jump to:

Airline transfer partners

Point transfer are almost instant to about half of their partners and can take a couple of days to most of the others. Transfers to Aeromexico, Air France / KLM Flying Blue, Avianca, Cathay Pacific, Emirates, Etihad, JetBlue, and Virgin Atlantic are almost instant. Transfers to EVA, Malaysia, Qantas, Qatar, and Turkish take a couple of days. Transfers to Thai can take up to a week.

Citibank occasionally run promotions where you’ll get a better-than-normal rate for transferring your points to a specific partner program during the promotional period. See Take Advantage of Transfer Bonuses to Get More Value from Your Reward Points for more information or visit Frequent Miler’s Current Transfer Bonuses page for a list of current promotions.

| Star Alliance (United) |

SkyTeam (Delta) |

Oneworld (American) |

Other |

|---|---|---|---|

| Singapore (KrisFlyer) | Air France / KLM (Flying Blue) | Cathay Pacific (Asia Miles) | Jet Blue |

| Turkish Airlines |

Aeromexico | Qantas | Emirates |

| Avianca | Malaysia | Virgin Atlantic | |

| EVA Air |

Etihad | ||

| Thai | Qatar |

Turkish Airlines can be a pain to deal with, but has some incredible award rates for domestic, Hawaii, and Mexico travel. And they don't partner with the other bank programs.

Singapore, Flying Blue, Cathay Pacific, and Avianca are good frequent flyer programs, but they also are partners with Ultimate Rewards and/or Membership Rewards. Unlike Ultimate Rewards and Membership Rewards, ThankYou Rewards doesn’t partner with any of the big US airlines and doesn’t have a partner that helps avoid fuel surcharges on Star Alliance or SkyTeam.

JetBlue operates a fixed-value points program, so you can receive around 1.3 - 1.5 cents per point when you purchase tickets, without having to worry about award availability.

Remember that you can use miles from any of these programs to book awards with any of that program’s partner airlines. So you can transfer your ThankYou points to Singapore Airlines and then use the Singapore miles to fly United, any of the two dozen or so other airlines that are part of the Star Alliance, or any of Singapore Airline’s other partners. With all the programs and partnerships, you can redeem your ThankYou points for flights on over 100 airlines.

Hotel transfer partners

1.5 Hilton points is only worth about 0.675 cents. That is even less than what you can get by "cashing out" your points.

| Hilton (1000:1500) |

Cashing out your points

If you link a Citi Rewards+ card to your account, you'll get a 10% rebate on the first 100,000 points you redeem each year. This provides an 11% boost to every redemption option. For example, you'd get 1.11 frequent flyer miles for each point or 1.11 cents per point for paying mortgages (instead of 1 mile or 1 cent).

There are lots of ways to use your ThankYou points at values of about 1 cent per point. You'll typically receive more value if you can use your points for frequent flyer tickets, but if you find that you can never find good opportunities, you can always just "cash out" your points.

- If you have an opportunity to fly Jet Blue, you can always get decent value from your points. They operate a fixed-value frequent flyer program where the number of miles you need is based roughly on the price of the ticket. You get around 1.2 - 1.5 cents per mile on pretty much every flight, without having to worry about award availability.

- If you have the Citi Prestige card, you can convert your points to cash. You'll receive 1 cent per point. This is more convenient than buying gift cards or travel. You've got two options. You can redeem increments as small as $10 directly to your credit card statement (link) or you can redeem in $50 increments and receive as a check in a week or two (link).

- If you don't have a Prestige card, you can still cash out by "paying your mortgage or student loan". You'll receive 1 cent per point and can redeem in increments of $50. Citibank will send you a check, made out to your bank. In many cases, checks made out to a your bank could simply be deposited directly into your checking account.

- You can buy gift cards. You'll typically receive around 1 cent per point. They often have sales where you can purchase certain brand's cards for even less, but there is no way to see a list. You'll need to click through different brands to check their pricing. A wide variety of popular brands is available, but you can't buy Amazon cards. Gift card page.

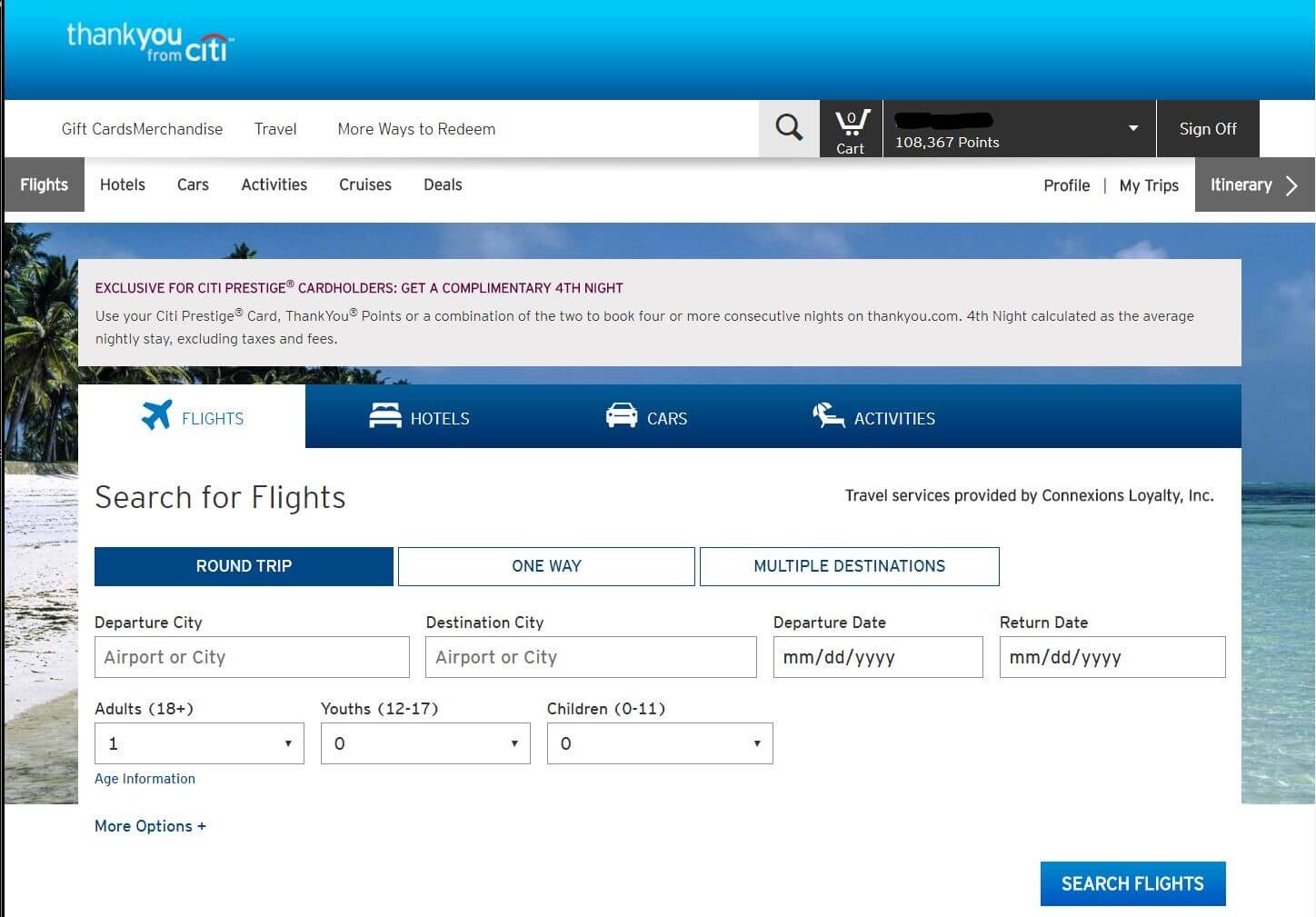

- You can purchase travel through the Citi Travel Center. For anyone that had the Citi Premier card before April 2020, this is the most lucrative option because you get 1.25 cents per point until April of 2021. Otherwise, you will only a "face value" of 1 cent per point. For example, if you wanted to make a purchase that cost $220, you would need to use 22,000 points.

The real value is lower. There are advantages to buying your travel on other websites. For example, if you are booking a hotel, you'll almost certainly be able to find a cheaper rate on the hotel's own website or one of a number of other hotel booking options. Furthermore, Citibank reservations are considered 3rd party reservations, so you won't be entitled to participate in the hotel's own loyalty program. In addition, you won't receive valuable credit card points on these travel purchases.

The best option is usually airfare, because at least the prices are usually the same across the web.

There are other ways to use your points that earn significantly less than 1 cent per point, such as paying bills or getting a statement credit. More details.

ThankYou Reward credit cards

Promotional signup offers are sometimes available that are higher than the typical signup bonuses shown below.

| Card | Typical Signup Bonus | Bonus Categories | Effective Annual Fee |

|---|---|---|---|

| Citi Prestige | 50,000 | 5x restaurants

5x airfare and online travel agencies 3x hotels and cruises 2x entertainment (until September) |

$100-$245 |

| Citi Premier | 60,000 | 3x restaurants

3x airfare, hotels, and online travel agencies 3x groceries 3x gas |

$95, waived first year |

| Citi Rewards+ | 15,000 | Rounds up rewards to nearest 10 | $0 |

| Citi Double Cash | 0 | 2x on all purchases | $0 |

| AT&T Access | 10,000 | 2x online retail and travel purchases

2x AT&T |

$0 |

The points you earn from the Double Cash, Citi Reward+ and the AT&T cards can’t normally be transferred to frequent flyer programs. However, if you have the Citi Prestige or Premier cards, you can temporarily transfer your points to the account associated with that card and then onto one of Citibank's airline partners.

Because you can receive the Citi Prestige’s travel credit every calendar year, it is possible to receive up to $500 in travel credits during the first year you have the card, which covers the $495 annual fee.

Collecting multiple signup bonuses

- You can earn one ThankYou point signup bonus every 24 months. More accurately, you can only earn the signup bonus if you haven't opened or closed a Prestige, Premier, Preferred, or Rewards+ card in the past 24 months. While closing a card resets the clock, converting a card should not. You can convert to almost any Citibank card, but you'll usually want to convert to a Reward+ card to keep access to any ThankYou points that are still associated with the card.

- Be careful about cancelling your cards. If you cancel a ThankYou card, you will only have 60 days to use any associated points, even if you still have another ThankYou card still open. In addition, you will reset the clock for earning a new bonus. If you no longer want the card, convert it to a Rewards+ card. If you have an extra Rewards+ card and you've already spent all the points you've earned with the account, cancel it right after applying for a new ThankYou card. That way, you won't need to wait more than the same 24 months before your next bonus.

- If you are collecting signup bonuses, you should try to collect a bonus every two years. Even if you want to hold onto both the Premier or Prestige card, you can convert one of them to a Reward+ card and then apply for a new Premier or Prestige card. The Premier card usually has the better signup bonus.

- Avoid earning the signup bonus on the Rewards+ card. It will block you from earning a more lucrative bonus from one of the other cards. Either wait to get one until it is time to get rid of one of your other ThankYou cards or apply for it a couple of weeks after you apply for one of the other cards (and make sure you don't earn the signup bonus on it before you earn the bonus on the other card).

Even though they can earn ThankYou points, the AT&T Access and Double Cash cards don't count as part of the same "family". Opening and closing them has no affect on your eligibility for the other ThankYou cards.

If you want to make the Citi Prestige card part of your core credit card collection, get it first. Two years later, get the Premier Card. Then just before the annual fee is due, downgrade the Premier card to the Rewards+ version. About a year later, you can apply for the Premier card again. If you don’t care about holding onto the Citi Prestige card, you can do the same thing, but sign up for whichever card has the highest signup bonus each time.

Bonus category opportunities

Earning ThankYou points on your spending is primarily interesting for people who are comfortable using their points for frequent flyer tickets. While you can cash out your points for 1 cent each, they are much more valuable when you transfer them to frequent flyer programs.

- If you have the Citi Premier Card (or Citi Prestige Card), you can convert points from the Double Cash card to airline miles. This makes the Double Cash card the most rewarding general-purpose card other than the Amex Blue Business Plus card.

- The Citi Premier card is the most well-rounded bonus category card available. For $95, you earn 3x transferable points on all of the major bonus categories: travel, restaurants, groceries, and gas. However, bonus points on travel are are only available for airfare, online travel agencies, and hotels. While you can earn more valuable rewards in specific categories with some other cards, the Premier and Double Cash combination is the most straightforward way to optimize the number of frequent flyer miles you earn from your spending, especially if you aren't willing and able to get business cards.

- The Citi Prestige card boosts your travel and restaurant rewards even higher. It earns an extra 2x points on restaurants, airfare, and online travel agencies (and an extra point on cruises). You can multiply your expected spending in these categories by the value of 2 Thank You points (3 cents per point) to see if it is worth paying the Citi Prestige card's effective $245 annual fee. Take into consideration that if you have the Amex Platinum or Sapphire Reserve card, you may want to use those for your airfare spending, in order to take advantage of their travel insurance benefits.

- The AT&T Access card's bonus rewards on online shopping is no longer particularly interesting. You can earn the same 2x points with the Double Cash card, which also earns the 2x rewards on all other spending.

Point transfers and expiration

- You can transfer your ThankYou points to anyone’s account, but any unused points will expire 90 days later. The number of points you can transfer or receive each year is capped at 100,000 points.

- You can only transfer points to a frequent flyer account that matches the name on your ThankYou account. However, you can always transfer points to someone else’s ThankYou account and they can transfer them to their own frequent flyer account.

- Rather than having a centralized ThankYou account, you start out having separate accounts for each credit card (or bank account). You can combine your accounts. But, if you do, the points are still associated with the credit card or bank account that earned them. If you close an account, you'll lose any unused points that were earned with that card, 60 days later.

- If you don’t want to lose your points when you cancel your card, you either need to use them, transfer them to the frequent flyer program where you expect to get the most benefit later, or convert your card to the no-annual-fee Citi Reward+ card. If you convert your card, and you don’t have another Citi Prestige / Premier card (in your household), you’ll lose your ability to transfer to partner loyalty programs.

Advantages of Citibank banking relationships

- Citigold customers get an additional $145 discount on the Citi Prestige Card's annual fee. This drops the effective annual fee to $100 per year. This requires $200,000 in combined assets with Citibank, but this includes assets in a brokerage account. If you have a substantial amount of existing retirement or investment accounts that you wouldn’t mind moving over to Citi, you can pay a lower fee on your Prestige Card.

- You can also earn ThankYou points directly from your banking activity. With the Citigold account, you can earn up to 1,600 points per month, depending on how many different Citibank banking and lending programs you use. With a regular Citibank account, you’ll earn less from each program, with a maximum of 1,000 points per month. You can also periodically earn large numbers of points as a banking account signup bonus. Be aware that unlike the points you earn with credit cards, these points will expire 3 years after the end of the year when you earned them and can’t be transferred to other people. In addition, they can’t be directly transferred to partner loyalty programs. If you want to use them for award tickets, you’ll need to temporarily transfer them to your Citi Prestige / Premier account first.

It has been reported online that if you were a Citigold customer and you are not any longer, you may still get the lower annual fee.